As the countdown gets closer to the deadline, the Digital Operational Resilience Act (DORA) regulations are about to become a reality for the financial services sector.

DORA, formally adopted in 2022, establishes technical standards to protect European customers from cybersecurity threats by setting standardised requirements for the security of network and information systems within the financial sector. Financial entities and their critical third-party ICT service providers must implement these standards in their ICT systems by January 17, 2025.

After the deadline, enforcement falls to each EU member state’s designed regulator. The regulators can impose administrative, financial or criminal penalties if the financial institution fails to comply with the DORA regulations.

Under DORA, lead overseers can impose fines on ICT providers up to 1% of their average daily global turnover from the previous business year. These fines can be applied daily for up to six months until the providers achieve compliance.

To comply with DORA regulations, financial services require oversight of all contractual agreements with ICT vendors., providing a comprehensive digital resiliency framework. The regulations include the minimum terms that need to be included in any ICT contract.

Using AI to Beat the Deadline

However, the manual process of reviewing contracts can be time-consuming, error-prone, and costly. This is where Artificial Intelligence (AI) comes into play, offering a smarter approach to contract analysis.

Here are the top five benefits of using AI for contract analysis under DORA regulations:

1. Rapid Identification of Non-Compliant Clauses

One of the biggest challenges of managing ICT vendor contracts under DORA is identifying clauses that fail to meet regulatory standards. Financial entities need to ensure their contracts have a robust ICT risk management framework, as any gaps can result in significant compliance risks. AI enables organisations to scan through thousands of pages of legal documents and pinpoint clauses that are missing, outdated, or non-compliant. This not only saves time but also ensures that no critical details are overlooked.

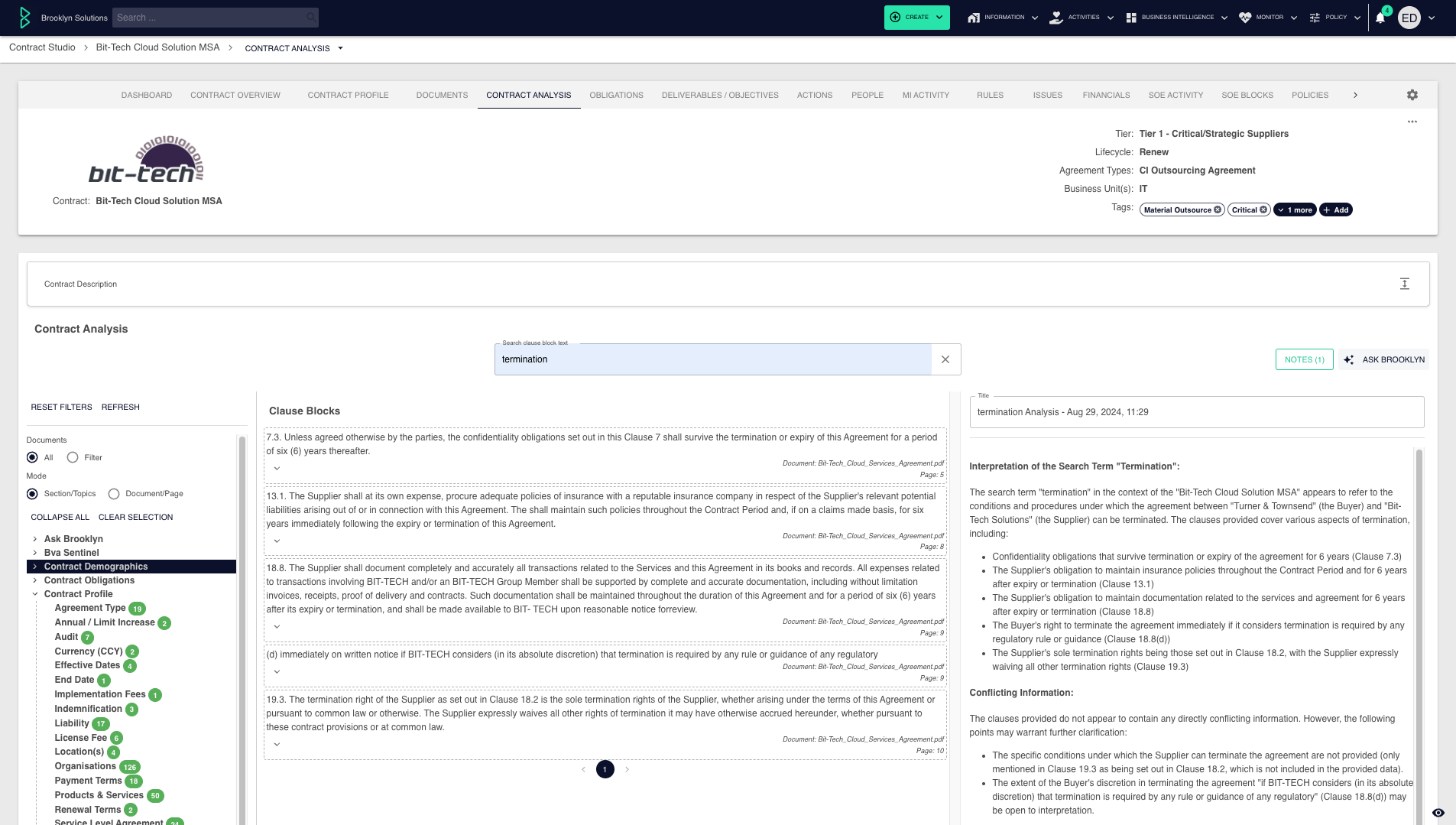

Brooklyn’s Contract Studio allows you to search thousands of contracts in a matter of minutes to create an auditable log of those contracts that are compliant with DORA regulations and interpret contract language using Machine Learning to flag those that aren’t. The Platform’s Built-in GenAI Assistant will summarise the contracts letting you know which suppliers need an urgent review ahead of the deadline.

2. Automation of Risk Management Processes

Under DORA, managing risks associated with ICT vendors is a core requirement. This involves constant reviews to identify potential risks, assess their impact, and implement mitigation strategies. Traditionally, these tasks are resource-intensive and prone to human error. AI can automate the entire process, detecting non-compliant clauses, generating risk scores, and recommending actions for risk mitigation. This level of automation streamlines risk management and minimises the likelihood of missing critical risks, enhancing overall compliance readiness.

3. Enhanced Efficiency

Manual review of ICT vendor contracts is not only time-consuming but also expensive. Compliance teams often spend countless hours reviewing each clause to ensure alignment with DORA regulations, diverting resources from other critical tasks.

By leveraging AI, financial institutions can dramatically reduce the time and effort required for contract analysis. It provides a solution to process large volumes of contracts faster than humans, whilst increasing overall efficiency and enabling businesses to allocate resources more strategically.

One Step Ahead, with Brooklyn's GRC Solution

4. Improved Accuracy and Consistency in Contract Reviews

Traditionally when handling a large volume of complex contracts, businesses would be required to outsource or hire resources to review them against risk policies or renegotiation for non-compliant contracts. This approach can result in a significant impact on your budget and a high chance of human error.

Under DORA, a missed non-compliant clause can lead to hefty fines or reputational damage. AI-driven contract analysis eliminates these inconsistencies by applying a standardised approach, ensuring each contract is reviewed with scrutiny and precision, which is crucial for maintaining compliance and avoiding costly penalties.

5. Proactive Compliance Management and Future-Proofing

With the DORA compliance deadline fast approaching, financial entities must stay ahead of evolving regulatory requirements. Relying solely on manual processes makes it challenging to keep up with changes and respond proactively. AI-driven contract analysis offers a future-proof solution that not only aids in current compliance but also adapts to new regulations as they emerge. AI continuously learns and updates, ensuring contract reviews are aligned with the latest standards. This proactive approach helps financial services minimise compliance risks and ensures long-term operational resilience.

How Brooklyn’s AI-Contract Analysis Can Help with DORA Compliance

AI brings immense benefits to contract analysis. Brooklyn offers a powerful AI-Contract Analysis feature tailored specifically for DORA regulations.

Brooklyn’s Contract Studio provides full visibility of your contracts. Move away from static PDF documents and data silos, and digitise all your contracts within one platform.

Our SEO functionality uses machine learning (ML) to extract key terms and clauses from the contract, extracting all key information into an easily digestible format. Become DORA compliant by using the search functionality to identify which contracts are compliant and those currently at risk, identifying missing, outdated, or non-compliant clauses.

Our Built-In GenAI Assistant ‘Ask Brooklyn’ can summarise the contract or individual clauses to simplify the terminology, making it easier to assess contracts at scale.

Looking for help to ensure your contracts are compliant with DORA? Ask your GenAI Assistant, for the latest regulation requirements, list the clause terminology that needs to be in the contracts, and compose your negotiation email to the supplier or even your meeting agenda for the next review.

Brooklyn’s AI-Contract Analysis feature offers a comprehensive solution that simplifies contract analysis whilst ensuring robust and ongoing compliance under DORA regulations. By embracing AI, financial entities can reduce costs, improve efficiency, and maintain a proactive stance toward regulatory compliance before the January 2025 deadline.

Book a meeting with our team today to start preparing your third-party compliance.

About the Author

Nick Francis, Chief Technology and Marketing Officer at Brooklyn Solutions

Nick Francis is a well-established and experienced CxO delivering Digital & Security-focused Transformation through the design, build, and deployment of cost-effective, highly automated industry-leading solutions. Nick has experience working across the private and public sectors in industries such as Financial Services, Insurance, Legal, Utilities, Retail, Public Sector and Government.

Specialised in compliance, risk & control activities in highly regulated industries, standardisation of technologies, streamlining of internal processes and continuous improvement driving consistency and efficiency across an organisation whilst holding Customer, Colleague and Partner experience at a premium.