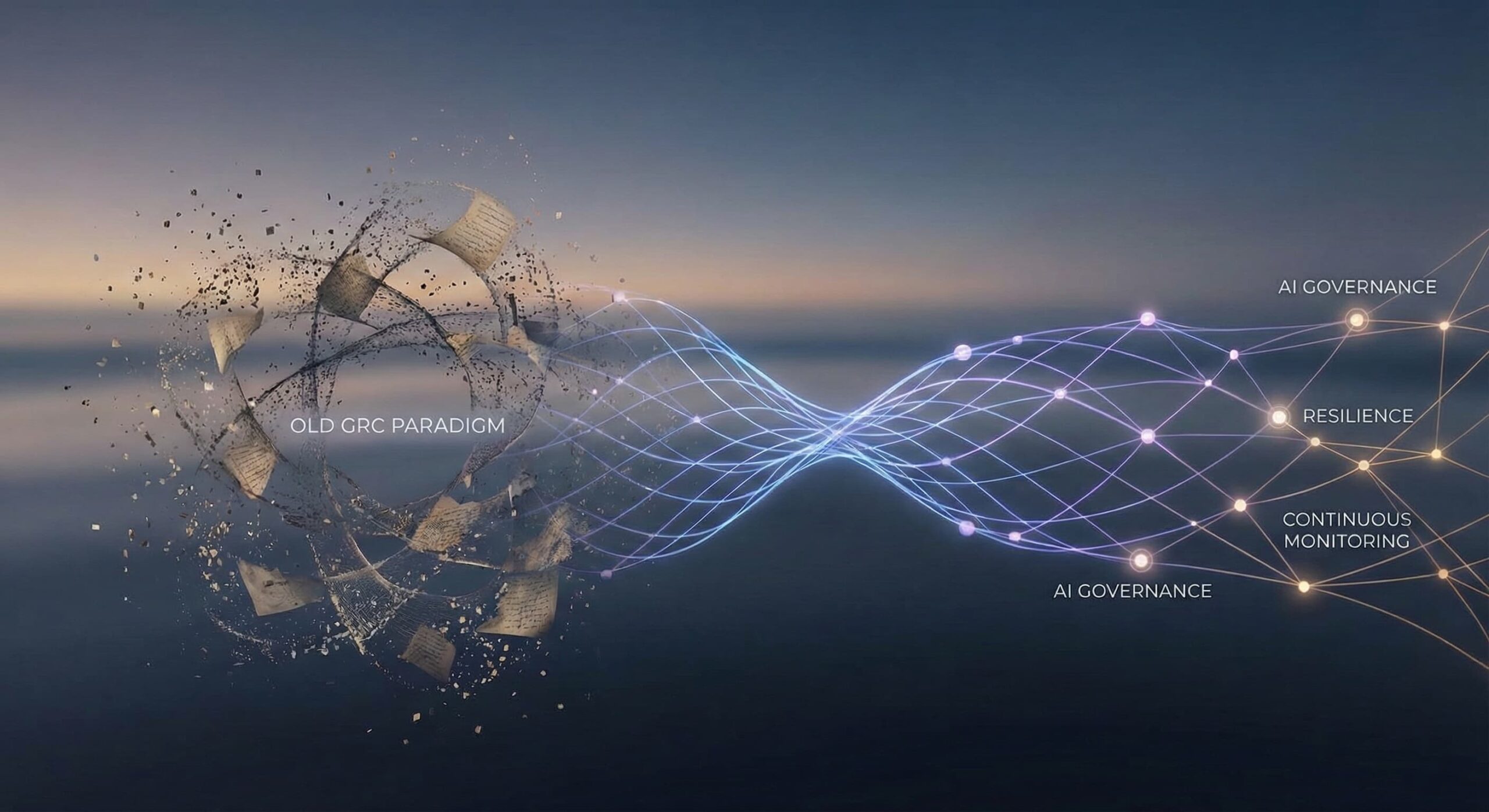

If you still think Governance Risk and Compliance is just a dusty binder sitting on a shelf waiting for an annual audit, things have changed, and nothing is changing faster than the use of Agentic AI in GRC.

As we move through February 2026 the landscape has shifted from a check the box chore, into a high stakes real time survival game. With the rise of autonomous AI geopolitical volatility, and the SEC obsession with AI washing the old way of doing things isn’t just slow it is a liability.

Here is the reality of GRC in 2026 and how to ensure your organization doesn’t end up as a cautionary tale.

The Rise of Agentic GRC

The biggest news hitting the wire this month is the shift from GenAI, to Agentic AI in GRC. A recent 20 million dollar Series A funding round led by Google Ventures for an AI native GRC platform signaled a permanent shift in the industry. We are now deploying autonomous agents that do not just write emails they approve financial actions modify system configurations and execute tasks with minimal human intervention

-

The Problem Traditional GRC models cannot keep up with a colleague that thinks at the speed of light.

-

The Fix Leading firms are moving toward Continuous Controls Monitoring If an AI agent deviates from policy at 2:00 AM the system must catch it at 2:01 AM not during next quarter audit.

AI Washing is the New Greenwashing

The SEC and other global regulators have officially shifted their gaze In early February 2026 reports emerged that AI Washing or overstating and mischaracterizing AI capabilities is now a top examination priority.

The SEC Division of Examinations has explicitly put AI advancements on their 2026 hit list If you claim your product is AI driven but it is really just a series of if then statements the regulators are coming for your lunch money Transparency is the only currency that matters Regulators are moving from Trust but verify to Show me the code the data lineage and the bias mitigation strategy.

The August 2026 Cliff

If you operate in Europe, the clock is ticking. The EU AI Act reaches a massive milestone on August 2 2026, when full enforcement begins for high risk AI systems, like those used in HR credit scoring and critical infrastructure.

This is not just an IT problem. It requires a Living Documentation strategy where your risk management human oversight and data lineage are audit ready at a moment notice.

Resilience Over Prediction

Latest news from global cybersecurity summits highlights that while AI is getting smarter at maths, it is also making cyberattacks more sophisticated This is why we are seeing a massive shift toward Operational Resilience driven by DORA and NIS2 regulations.

-

The Shift It is no longer about if you will be disrupted but how fast you can get back up.

-

The Requirement Regulators are now demanding no fail tolerances for vital services and 24 hour notification windows for major incidents.

How to Win in 2026 The Strategy Checklist

Priority: Action Item Kill the Spreadsheet: If your risk registry is in a manual file you are already behind Move to an integrated automated platform Audit your AI: Create a Shadow AI inventory. Know every tool your employees are using before the SEC asks Quantify the Risk: Stop talking in High Medium Low Start talking in dollars and downtime The Board speaks ROI not cyber vibes Own the Third Party: Your vendors are dependencies If their AI fails your compliance fails.

The Bottom Line

GRC in 2026 is no longer the Department of No It is the Department of How It is the engine that allows your company to move fast without flying off the tracks.

The companies that thrive this year will be those that treat governance not as a hurdle but as a competitive advantage. Because in a world of autonomous chaos the one with the best brakes is the only one who can safely drive at 200 mph.