Ensure EBA Regulatory Compliance with Confidence

Brooklyn Solutions empowers organisations to meet evolving EBA regulatory standards efficiently, helping you stay ahead of the ever-changing regulations and focus on your core business.

What is EBA and

Why Does It Matter?

The European Banking Authority (EBA) sets regulatory standards for EU financial institutions to strengthen stability and protect consumers. EBA compliance requirements guide how firms manage outsourced functions and maintain effective oversight. Audits are becoming more stringent, so organisations need robust processes and complete documentation to remain compliant and avoid penalties.

Prepare for EBA audits by clarifying critical functions, maintaining an accurate outsourcing register, and performing ongoing due diligence and monitoring to demonstrate continuous compliance.

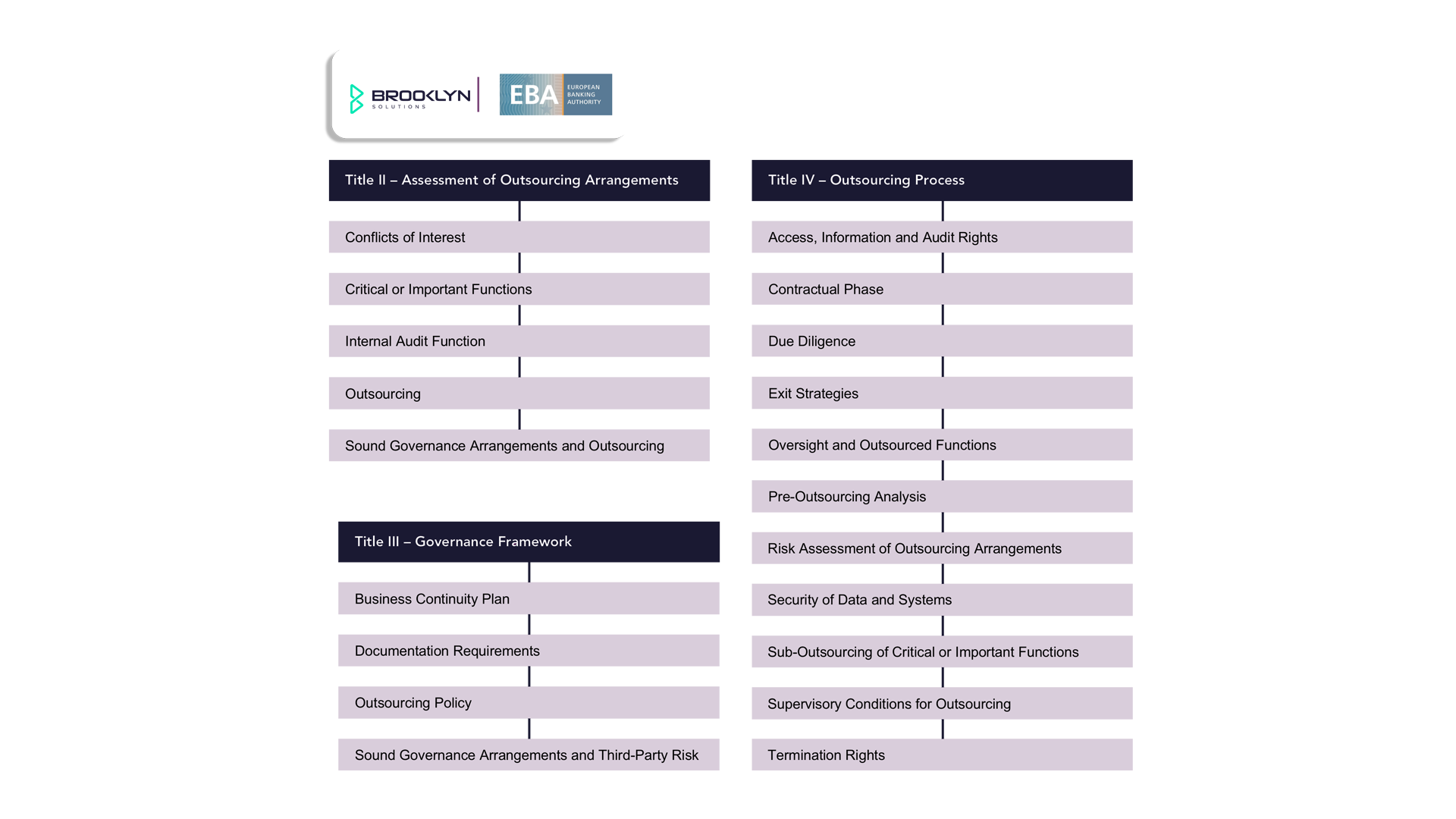

What the EBA Outsourcing Guidelines Require

The EBA Guidelines define how EU-regulated firms must manage outsourced functions. Under these regulations, organisations must:

-

Identify critical functions.

-

Maintain a comprehensive outsourcing register for EBA audits

-

Perform due diligence and risk assessments before onboarding a third party.

-

Prepare exit and continuity plans for key service providers.

Brooklyn EBA Outsourcing

The Brooklyn Platform can help simplify and strengthen EBA Outsourcing compliance. A unified, collaborative solution to manage governance, risk, and compliance.

- Streamline compliance workflows and audit preparation

- Minimise vendor risk and potential regulatory penalties

- Maintain full visibility and control over your third-party relationships

EBA Outsourcing Compliance, Simplified

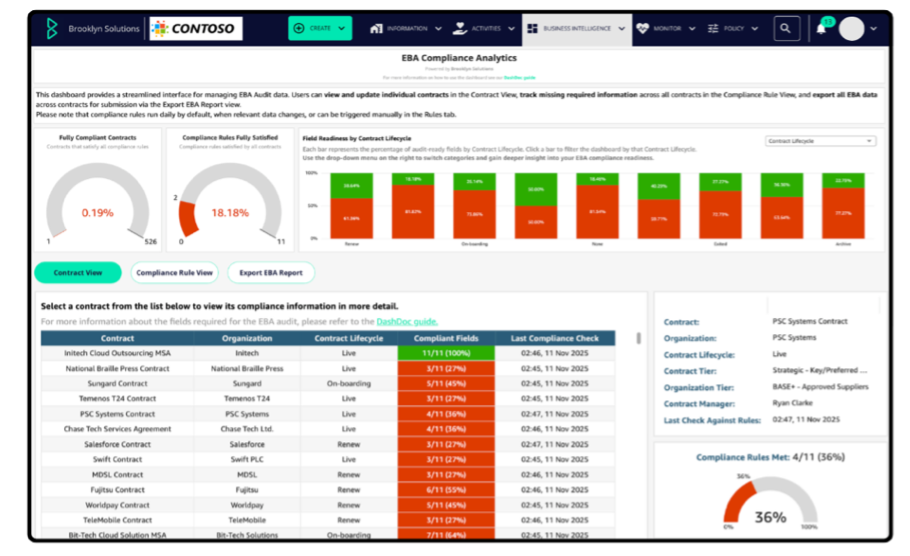

Digital EBA Compliance Register

Brooklyn provides a dedicated EBA outsourcing compliance register presented as an intuitive dashboard. It consolidates all required fields for EBA reporting, links to contract pages, and updates in real time. Each contract profile includes an EBA Regulation tab that highlights what is required and flags missing or incomplete information so teams can close gaps quickly and stay ready for audit.

Simplify Due Diligence

Automate due diligence through surveys within contract workflows to collect key details, impact assessments and risk profiles. Contracts and service levels are centralised in a secure repository with automated renewals, compliance checks and supplier actions. Organisational relationship hierarchy maps parent entities, subsidiaries and suppliers in one view to expose dependencies and hidden risk for better governance and decision making.

Compliance Analytics & Instant Visibility

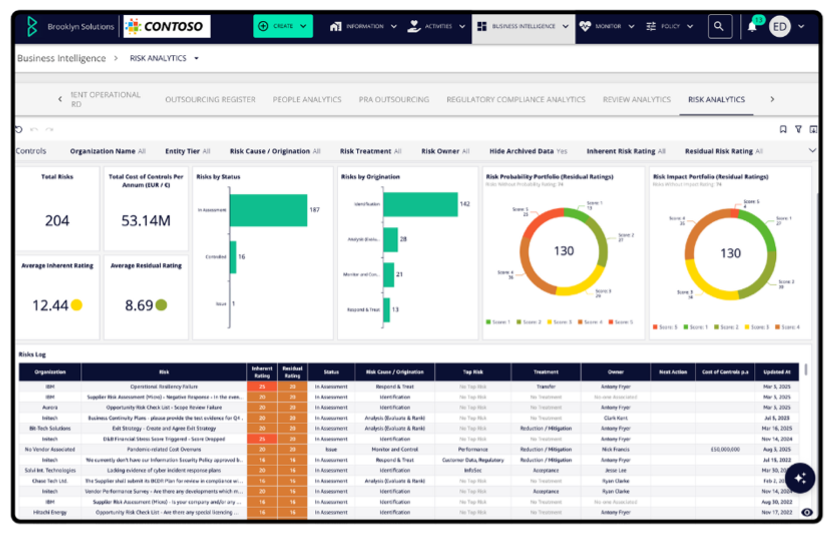

Our analytics dashboard shows visual indicators of compliance readiness across all contracts, highlights missing information and tracks progress to being digitally-fit-for-audit. Real-time monitoring surfaces compliance breaches, operational failures and reputational risk with instant alerts and automated action workflows so teams resolve issues before they escalate. External data feeds and AI, including partners such as Creditsafe and Dun and Bradstreet, enrich risk profiles to improve oversight and speed decisions across the third-party ecosystem.

Outcomes You Can Expect

-

Be audit-ready at all times with a live outsourcing register and exportable reports.

-

Reduce vendor risk with continuous monitoring, alerts, and clear accountability.

-

Save time by automating control evidence, reviews, and attestations.